Fiscal Period Rollover

Fiscal Period Rollover is the process of moving your acquisitions data from one fiscal year to the next. The process involves creating a new fiscal year definition, reviewing data from the year that is ending, making assertions on how that data should move, copying ledgers and funds from one year to the next, then copying open orders into the new ledgers while closing orders and invoices that are complete in the ending year. In Alma, you'll manage the technical steps of this process using two rollover jobs that cover different parts of the process.

Rollover Process Overview

The rollover process takes place in stages, starting with a ledger rollover, then some data review on ledgers and funds. This would be followed by the PO line rollover. Though these stages could be performed in quick succession, institutions should not expect to perform all of these tasks in a single day if they will be doing any in depth changes to ledger and fund structures or ensuring that only selected PO lines should be rolled over.

- Run the ledger and fund rollover in draft mode.

- This step is required to create the new fiscal period, which is a one-time task.

- This provides a draft view of how the existing ledger will be copied to the new fiscal year. This is your opportunity to decide whether to continue using the previous ledger and fund structure in the new year, or to consider changes to that ledger before rolling it, or to start with a fresh ledger.

- Activate the new ledger.

- PO lines cannot rollover without a new, active ledger in place.

- Money cannot be allocated to funds unless ledgers and funds are active.

- Run PO line rollover in report mode.

- Report mode identifies which PO lines Alma considers to be open and eligible to roll, and identifies which transactions will be rolled.

- This your opportunity to determine if there are PO lines rolling that should be considered closed, and also determine if any PO lines are missing that should be considered open. This may also provide an opportunity to perform year-end clean-up of orders.

- Run the PO line rollover in active mode.

Roles Needed for Rollover

In order to update fiscal period details, you will need either the Acquisitions Administrator or General System Administrator role.

In order to access the rollover jobs, you will need the Fiscal Period Manager role. CARLI Office staff are available to assist with running these jobs on the timing and specifications you request.

To modify and activate funds and ledgers, you will need the Fund Manager role. Staff that assist with reviewing ledgers but not making changes may use the Fund-Ledger Viewer role.

To modify PO lines, you will need the Purchasing Manager or Purchasing Operator role. To modify invoices, you will need the Invoice Manager or Invoice Operator role.

Timing for Rollover

In Alma, each fiscal period is strictly defined as one year, 365 (or 366) days in length. During migration, your library identified your institution's fiscal period start date, which Ex Libris configured into your Alma settings. Fiscal period definitions are used primarily by acquisitions functions, and secondarily by Alma analytics, which associates the fiscal period name with the date ranges calculated internally using the fiscal period start date.

Each institution may choose its own schedule for running rollover activities. Alma allows these jobs to be run at any time, and Alma also offers the ability to run these jobs in "draft" or "report" modes, allowing a preview before committing changes into a new year. The ledger and fund rollover may be performed any time in advance of the end of the fiscal year. While the PO line rollover should happen on or around the actual fiscal period start date.

Each institution that uses Alma acquisitions functionality must perform the ledger rollover at least once. This first run creates the new fiscal period, which must be in place for any future ledgers and PO lines. An institution may then decide whether to perform the rollover steps to move existing data to the new fiscal year, or to create new ledgers and start over with PO lines in the next year.

Institutions that do not use Alma acquisitions functionality may choose to perform the ledger rollover. The fiscal period created by rollover is associated with date ranges used in Analytics, which may be applied to report on activities (e.g., loan activity) occurring during the institution's fiscal year. Institutions are encouraged to perform this update to keep fiscal year names consistent for reporting.

Preliminaries

There are a couple tasks that library staff should perform before starting with the rollover process. These include cleaning up the fiscal periods table.

Cleaning up the Fiscal Period Table

- Go to Alma Configuration.

- Go to Acquisitions menu > General > Fund and Ledger Fiscal Period.

The fiscal period mapping table will include a list of all of the fiscal periods that were configured in Alma or previous systems. The list may or may not be sorted in description or date order. You may only edit two types of values in this table: the description for a fiscal period, and the status of a fiscal period. Note: You may not add or delete rows or make changes to the dates of fiscal periods. The enabled sliders, import, and add row options have no effect.

Your task at this time is to make sure that any previous fiscal periods that you don't want to consider for rollover are marked with a status of Inactive. This will prevent the ledgers for those periods from appearing as eligible to be rolled by the Rollover Ledgers job. Ideally, you should only have one fiscal period with an Active status before you begin rollover, that being the current fiscal period that you are ending.

To change the status of a fiscal period, locate the row for a period, select the drop-down list for the status column. If the status is Active, change the status to Inactive or Closed. (Ex Libris documentation states these are functionally the same; Closed may simply identify that a staff member made the change, rather than the action of the system.) Click Save when you have finished deactivating older fiscal periods.

Ledger and Fund Rollover

The ledger rollover sets up a new fiscal period and copies ledgers from one year to the next. The rollover job itself does a couple things:

- Creates a new fiscal period;

- Copies any selected ledgers from the active fiscal period to the new fiscal period;

- Assigns the starting allocation level for allocated funds within the new ledger.

The rollover process allows you to perform these actions in draft mode, which copies the ledgers and funds but leaves them in Draft status. Funds and ledgers in draft status are not yet active for transactions (including allocations), but all fields of the fund record may be edited, including fund codes. Rolling in draft mode provides the opportunity to review the rolled structure and consider any changes you might want to make for the new year. Draft ledgers may be deleted--using the rollover ledger job--or may be set to active.

Running the Rollover Funds Job

The fund and ledger rollover process is available from the Acquisitions menu > Advanced Tools > Rollover Ledgers. The Rollover Ledgers screen includes a list of all previous rollover jobs run. You may view the rollover reports of previous jobs by clicking the actions menu button [...] and then selecting View.

To create a new rollover job, click Add Job.

On the Add Job screen, you decide on the settings that will affect how the selected ledgers should be copied into the new year.

- Create Allocation From: Select what amount, if any, should be assigned as the initial allocation for rolled allocated funds.

- None: Set the initial allocation as $0.00. You will need to add funds to this fund after it is active in order to use the fund.

- Allocation Balance: Set the initial allocation as the current allocation level for the fund. E.g., if current allocation is $425, initial allocation of the rolled fund is $425.

- Cash Balance: Set the initial allocation as the current cash balance for the fund. E.g., if current allocation is $425 and $300 are expended, then the current cash balance is $125; initial allocation of the rolled fund is $125.

- Both: Set the initial allocation as the combination of the current allocation and cash balance for the fund. E.g., if current allocation is $425, and current cash balance is $125, then the initial allocation of the rolled fund is $550.

- Ledger: Select which ledger to rollover, or select All to roll every ledger into the next year.

- Action: Select whether to copy a ledger to the new fiscal period or to delete a ledger.

- Copy: Typically, you will select Copy to roll ledgers into the new fiscal year.

- Delete: In the context of the rollover process, you would use Delete in order to delete draft ledgers that you created but decided to not use.

- Create Status: You may create new ledgers in draft status, which allows you to edit details, or in active status.

- Draft: Rolling the ledger in draft mode allows you to edit any field in the rolled fund. Funds are not yet active, which means no transactions, including allocations, may be applied.

- Active: Rolling the ledger in active mode copies the ledger as is and sets the ledger as active. Active funds may be used for any transactions (PO lines, invoices), including allocations and transfers.

- From Year: Alma shows any existing fiscal periods that are still listed as active in Configuration. Be sure to select the current fiscal year (i.e., the year that is ending).

Click Add and Close. This will queue the job to run. You should receive an email when the job completes.

When the job completes, click the actions menu button [...] and then select View to see the ledger rollover report. The ledger rollover report identifies the settings selected and the count of ledgers and funds that were successfully rolled.

Updating the Fiscal Period Name

The first time that you perform the Rollover Ledgers job in a fiscal period, the new fiscal period will be created. While Alma creates the new fiscal period based on the previous year's date range, the name is created differently. If you would like to keep fiscal period names consistent, you should edit the name at this time.

- Go to Alma Configuration.

- Go to Acquisitions menu > General > Fund and Ledger Fiscal Period.

- Locate the row for the newly created fiscal period. The description column may read similar to "06/29/2022 - 06/28/2023".

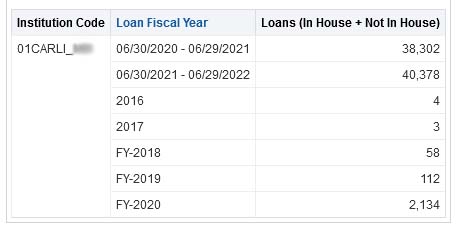

- Place your cursor in the description field, and modify the fiscal period description to your preference, e.g., "FY-2023". We recommend keeping consistency from year to year in order to make Analytics data more predictable.

- Click Save.

Working with Rolled Ledgers

When you roll ledgers, either in draft or active modes, your tasks will include reviewing that allocations are set according to the Create Allocation From setting, and that the ledger structure will be adequate for the start of your new fiscal year. Alma doesn't make it obvious that anything has changed, because the funds and ledgers screen defaults to using filters based on the current date. So you first have to find your new ledgers.

- Go to Acquisitions menu > Acquisitions Infrastructure > Funds and Ledgers.

- Locate the filter bar, then click Clear All.

- After the screen refreshes, use the facets to locate your new ledger and funds.

- Use the fiscal period filter to locate ledgers and funds for your new fiscal year.

- If you created the ledger in draft status, use the status filter.

Once you can see your new funds, review the records and structure for consistency.

- Allocated balance should be set according to the Create Allocation From setting of the Rollover Ledgers job. If you selected a non-zero option, then the amount should be calculated correctly.

- Remember that allocated funds are where transactions are recorded, so focus mainly on allocated funds.

- Summary funds will show the sum of all child funds.

- Ledgers will show the sum of all child funds.

- Expended balance should be $0.00

- Cash balance should be the same as the Allocated balance.

- Encumbered balance should be $0.00, because PO lines have not been rolled over yet.

If you're not satisfied with either the structure or the allocation outcome, then you would run the Rollover Ledgers job again using the create status of delete. You will then select to delete the ledger that you created previously.

If you are satisfied with the structure and the allocation outcome for the ledger, and the ledger is in draft status, then activate the ledger.

- From the funds and ledgers screen, use the facets to limit to the ledger record (e.g., Type: Ledger, Status: Draft).

- For the ledger record, click Edit.

- At the top of the screen, click Activate.

- When funds are activated, click Save.

PO Line Rollover

The PO line rollover identifies open orders, updates those line items to be available in the new fiscal period, and creates new encumbrance transactions on the newly-created allocated funds. The Rollover PO Lines job creates a report that library staff may use to review open orders and determine if these orders should be rolled, and also determine if any open PO lines have errors or problems that will prevent them from being updated into the new fiscal year. The Rollover PO Lines job has a report mode that allows you to get these reports as many times as you want before you commit to your actual rollover.

Running the Rollover PO Lines Job

The PO line rollover process is available from the Acquisitions menu > Advanced Tools > Rollover PO Lines. The Rollover PO Lines screen includes a list of all previous rollover jobs run. You may view the rollover reports of previous jobs by clicking the actions menu button [...] and then selecting View.

To create a new rollover job, click Add Job.

On the Add Job screen, you decide on the settings that will affect how the selected ledgers should be copied into the new year.

- New Encumbrance Calculation: Every PO line must have a non-zero encumbrance value. You may use the Rollover PO Lines job to automatically calculate and update a new encumbrance for the next year.

- Expenditure: Use the sum of expenditure transactions for this PO line as the encumbrance for the next year. This is useful for continuous orders such as periodicals and databases; it may also be useful for standing orders.

- Encumbrance: Use the existing encumbrance value from the the PO line as the encumbrance for the next year. This is useful for one-time orders, and may be preferred for some standing orders.

- FPC Factor (%): You may ask Alma to calculate an increase or decrease to the encumbrance option you chose.

- New Encumbrance = (New Encumbrance Calculation choice) + ((FPC Factor)*(New Encumbrance Calculation choice))

- For example, for continuous orders, you might be planning for a 5% increase to serials costs over the previous year: set the FPC factor to 5, and Alma will create an encumbrance that is 5% more than the amount expended in the previous year.

- This field is optional; leave the field blank to increase or decrease the calculated encumbrance.

- Setting the field to 0 does *not* zero-out the encumbrance for the future.

- From Year: Shows active fiscal periods that may have PO lines eligible to rollover.

- Normally, you will select the fiscal year that is ending.

- As noted in the Preliminaries session above, you may clean up this list by marking earlier fiscal periods as inactive or closed.

- Libraries: PO lines are associated with a library that has an acquisitions unit. Select the library (or libraries) that have PO lines that you want to rollover.

- If you have a centralized acquisitions unit for all libraries, you should be able to select only the library that coordinates ordering.

- If library acquisitions are not centralized, each library may run rollovers separately, or all affected libraries may be selected to roll all PO lines at one time.

- Alma will also show the Resource Sharing Library. You do not need to select this library unless you have created PO lines and budgets related to resource sharing transactions. (As of this writing, CARLI is not aware of any I-Share members doing this.)

- PO Line: Alma allows you to specify a single PO line to rollover.

- Check Over Encumbrance: Tick this box to have the job evaluate whether rolled PO lines will exceed the limits of an allocated fund. This is a tricky setting.

- If the ledger(s) and funds for the new fiscal year are not yet active, then checking over-encumbrance may report errors for all PO lines.

- On active funds, Alma only checks over encumbrance if the fund record includes over-encumbrance limits. If no over limit percent is set, the check may do nothing.

- Active funds must also have a non-zero allocation in order for a meaningful result (any % of $0.00 is still zero). If funds were rolled with a zero allocation, avoid using this setting.

- Report Mode: Tick this box to run the Rollover PO Lines job in a way that identifies the possible effects of a rollover without committing changes to any open PO lines.

- Types of Orders: You must specify which type(s) of orders that this job should affect. The options here pertain to the inherent type of PO line in the system, rather than the way you might refer to a specific order. CARLI recommends that you run the job on one type of orders at a time.

- Continuous Orders Only: Tick this box to apply the job to any PO lines with "Subscription" in the PO line type description.

- Standing Orders Only: Tick this box to apply the job to any PO lines with "Standing Order" in the PO line type description.

- One-Time Orders Only: Tick this box to apply the job to any PO lines with "One-Time" in the PO line type description.

Click Add and Close to run the job.

Working with the Rollover PO Lines Report

The primary tasks for library staff include reviewing the list of open PO lines and determining if any lines should no longer be considered open, then determining if any PO lines are missing from the rollover that should have been open. The Rollover PO Lines job report will provide an effective tool for identifying many of the issues found with rollover. PO line searches and Analytics reports will support this effort.

The PO line rollover process is available from the Acquisitions menu > Advanced Tools > Rollover PO Lines. The Rollover PO Lines screen includes a list of all previous rollover jobs run. You may view the rollover reports of previous jobs by clicking the actions menu button [...] and then selecting View. (Options for Events and Report both show the system response that generated errors, but these are not particularly helpful outside of a support perspective.)

The Job Events section provides the most practical data for the report, as it gives a summary of the different possible outcomes for PO lines and the number of PO lines affected. Each outcome is hyperlinked to a sub-report that lists the PO line numbers that would reach that outcome.

- Click the outcome link, then click the export button to save the list to Excel. You may then use this list to create a set of PO lines or create an filter in Analytics.

- Click the Export Events link to create an Excel file of all identified outcomes. Each outcome will have a separate tab and will include the PO line references and event information (used for support).

Likely events include the following:

- PO line rollover success: The PO line is an open order: the fund will be updated to the new fiscal period and an encumbrance transaction created.

- Next fiscal period does not exist: Since the Rollover PO Lines job may be run at any time, this indicates no one has run the Rollover Ledgers job.

- Fund for next fiscal period does not exist: Suggests that there is no corresponding fund in the new ledger for the PO line. This could indicate that the fund in the new ledger was deleted or the fund code was changed.

- No encumbrance linked to PO line: All PO lines must have a non-zero encumbrance. Edit the existing PO line to have something other than $0.00 as an encumbrance.

- Fund does not have enough money: Corresponds to the setting of checking overencumbrance limits.

- Fund is not active: The fund exists in the new ledger and fiscal period, but it hasn't been set to active.

- General error: None of the above. This may be indicated if there are problems with the PO line overall, but might also be associated with PO lines that have multiple funds assigned.

Resources

CARLI & CARLI Members

May 2024 Technical Services Q&A, "Annual Acquisitions Activities"

April 2022 Technical Services Q&A, "Timely Acquisitions Topics"

CARLI Shared Documentation Repository, Rock Valley College Fiscal Period Close Procedures